Professional network data

Leverage our top B2B datasets

Job posting data

Get access to hundreds of millions of jobs

Employee review data

Get data for employee sentiment analysis

Clean dataNEW

Enhanced professional network data

Employee data

Get data on global talent at scale

Funding data

Discover and analyze funding deals

Firmographic data

Unlock a 360° view of millions of companies

Technographic data

Analyze companies’ tech stacks

BY INDUSTRY

MOST POPULAR USE CASES

Investment

Leveraging web data for informed investing

HR tech

Building or enhancing data-driven HR tech

Sales

Supercharging your lead generation engine

Marketing

Transforming marketing with web data

Market research

Conducting comprehensive market research

Lead enrichment

Use Coresignal’s data for enrichment

Talent analytics

Analyze talent from multiple perspectives

Talent sourcing

Comprehensive talent data for recruitment

Investment analysis

Source deals, evaluate risk and much more

Target market analysis

Build a complete view of the market

Competitive analysis

Identify and analyze competitors

B2B Intent data

Lesser-known ways to find intent signals

BY INDUSTRY

MOST POPULAR USE CASES

Investment

Leveraging web data for informed investing

HR tech

Building or enhancing data-driven HR tech

Sales

Supercharging your lead generation engine

Marketing

Transforming marketing with web data

Market research

Conducting comprehensive market research

Andrius Ziuznys

Updated on April 25, 2024

What is investment analysis?

Investment analysis is a process that helps evaluate investments, industry trends, and economic cycles.

Understanding investment analysis methods helps you identify certain investment opportunities, anticipate future performance, and build a solid portfolio management strategy.

This article covers key aspects of investment analysis, types, and examples.

Investment analytics with Coresignal

If you're an investor looking for newly founded startup companies, company database is here to help you out. With firmographics, you can filter companies by specific parameters such as location, industry, headcount, and more.

It allows you to discover new startups more easily and take action immediately. You can differentiate established companies from startups by utilizing the "founding date" data point and checking the company's headcount.

Investment analysis examples

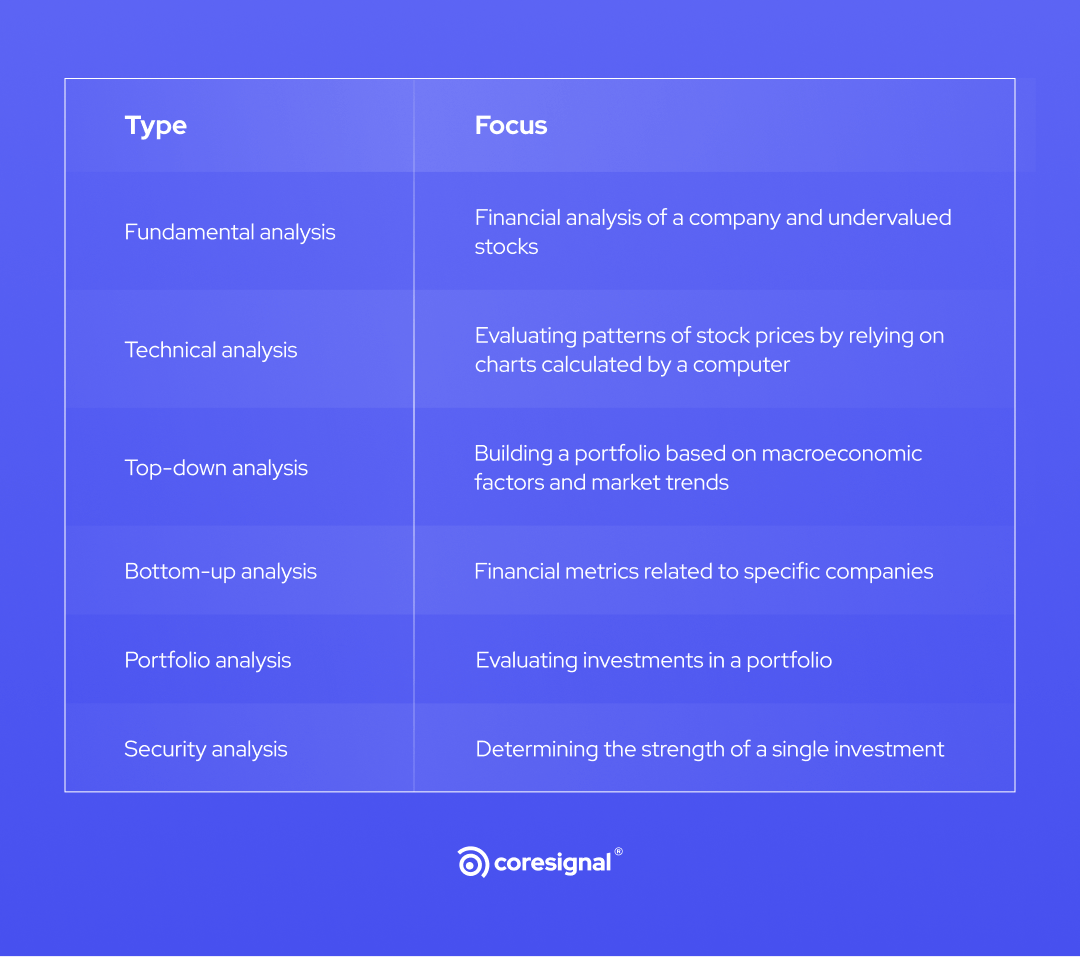

Investment analysis mostly consists of 6 types:

- Fundamental analysis;

- Technical analysis;

- Top-down analysis;

- Bottom-up analysis;

- Portfolio analysis;

- Security analysis.

Next up, you will learn how these types of analysis differ from each other.

Fundamental analysis

Fundamental analysis focuses most on the financial analysis and well-being of a company. This type of analysis helps search for stocks with significant potential for growth whose intrinsic value might have been negatively mispriced by the market.

Fundamental analysis also helps investors assess a company's financial soundness, future business endeavors, and dividend yield potential to see if it would be a viable investment.

Fundamental analysts are usually the ones who take a long-term interest in investing.

Technical analysis

Technical analysis focuses on evaluating certain patterns of stock prices by relying on charts calculated by a computer.

Technical analysts pay attention to price movements that indicate a pattern, trading signals, and other analytical charting tools that help identify the strengths and weaknesses of a security.

Technical analysis is usually used by short-term investors.

Don’t miss a thing

Subscribe to our monthly newsletter and receive the summary of our latest publications, data guides, and other news straight to your inbox.

By providing your email address you agree to receive newsletters from Coresignal. For more information about your data processing, please take a look at our Privacy Policy.

Top-down analysis

A top-down approach focuses on building a portfolio based on macroeconomic factors and market trends. Top-down investors evaluate investment opportunities based on their anticipation of stock market performance.

The primary choice for top-down investors is mutual funds and exchange-traded funds (ETFs). If that doesn't satisfy their needs, they also partake in individual stocks and bonds.

Bottom-up analysis

Bottom-up approach focuses on metrics related to specific companies. Bottom-up investors try to establish the financial health of a company by analyzing its financial statements.

The metrics of financial performance may include profit margin and earnings ratio.

Portfolio analysis

Portfolio analysis focuses on evaluating investments in a portfolio. You can use this type of analysis to determine the performance of a fund by comparing it to the benchmark index. Also, portfolio analysis allows seeing whether your funds are diversified in an appropriate way.

Last, but not least, portfolio analysts can conduct stress testing to identify weak links during unforeseen circumstances.

Security analysis

Security analysis focuses on determining the strength of a single investment. This type of analysis lays the fundamental ground for value investing, which revolves around buying assets that might be undervalued.

Investment analysis process

The process of investment analysis can take up a lot of your time, and rightfully so. It consists of many different elements, some of which change according to the situation and circumstances.

However, after reading about several factors that are essential in the investment process below, you will likely be able to enhance your investment strategies at least a little.

Company basics

Company information, also known as firmographic data, is all about the name, industry sector, management competence, location, founding date, and more.

You can do this research on your own by looking at the company's annual report, or you can outsource this data from a trusted data provider, such as Coresignal.

With Coresignal's firmographic data, you will be able to access both basic and more detailed company information. What's more, you will surely find the company you're interested in with our broad coverage of over 91M company records.

To top it off, all the data is regularly refreshed, so you won't have to wonder about its accuracy and legitimacy. Learn all you can about the company of your interest and leave no stone unturned.

Securities

Knowing the number of shares for a security, rights of each issue, and future plans for new shares is imperative to understanding whether the management is oriented toward shareholders.

If the management releases the company’s shares when the company's stock prices are at an all-time low, it could point out poor capital allocation and unreliable management.

Financial analysis

There are several key things to keep in mind in terms of the financial sector of the company: debt, interest coverage, current and quick ratio, and off-balance sheet liabilities.

Debt can drive a company into bankruptcy which would render your investment useless. It's safe to say that a company's financials are some of the key factors to determine a potential investment.

Performance

Measuring performance can be done by analyzing the company's revenue, profitability, and goals. However, some other factors may come into play. For example, the business may be seasonal and generate satisfactory profits only under a specific season.

Other companies may have different aspects of business. Therefore, it's important to be able to predict certain trends by implementing trend analysis or other types of predictive analytics.

Business strategy

Understanding the market in which the business operates helps predict its future performance in the long run. Let's say the company of your interest is in the real estate industry.

You'd want to analyze their project management capabilities, pricing power and compare it to its competitors in the same industry to determine the viability of this investment opportunity.

Also, you can take a look at the company's past experience. If it's been successful in spite of all the competition out there, it might give you the investment signal you needed.

Key takeaways

Investment analysis helps you find the best companies to invest in. It holds a significant amount of influence on your investment decisions and it's one of the most common methods to determine the financial situation of a company.

While investment analysis is a complex process, it's going to ensure that your investment opportunity is well-analyzed and worthy of funding.

Frequently asked questions

What is analytical investing?

Analytical investing refers to researching and assessing a security to anticipate its future performance. In turn, it determines its relevance to a certain investor.

What is return on investment analysis?

Return on investment (ROI) analysis refers to researching the probability of an investment generating returns.

What is capital investment analysis?

Capital investment analysis is a budgeting process used by companies and governments to evaluate and anticipate profits from a long-term investment.

What are the four steps of capital investment analysis?

The four steps associated with capital investment analysis are: value of cash flows, payback period, accounting rate of return (ARR), and internal rate of return (IRR).

Related articles

Sales & Marketing

10 Most Reliable B2C and B2B Lead Generation Databases

Not all lead databases are created equal. Some are better than others, and knowing how to pick the right one is key. A superior...

Mindaugas Jancis

April 23, 2024

Sales & Marketing

It’s a (Data) Match! Data Matching as a Business Value

With the amount of business data growing, more and more options to categorize it appear, resulting in many datasets....

Mindaugas Jancis

April 9, 2024

Data Analysis

Growing demand for sustainability professionals 2020–2023

Original research about the changes in demand for sustainability specialists throughout 2020–2023....

Coresignal

March 29, 2024